Transactions settle on the next business day, significantly shortening the capital turnover cycle

Helps merchants access operating revenue faster, optimizing cash flow

Enables better business expansion and operations

Committed to providing the platform's real-time optimal exchange rate, with absolutely no spread earned

Exchange rates are transparent, ensuring you receive maximum profit in every transaction

Dedicated to building a fair and trustworthy partnership, ensuring worry-free fund collection

Committed to driving continuous growth for merchants

Provides various marketing campaigns and platform promotions, empowering merchant business growth through new media and advertising promotions

Merchants will gain a constant stream of traffic and business opportunities, standing out in the fierce market competition

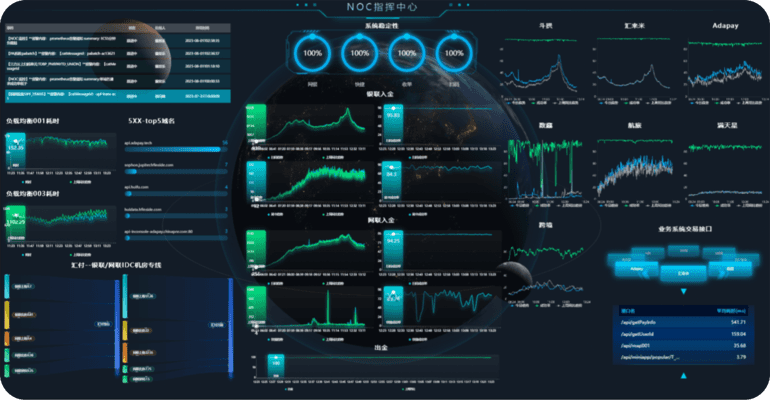

Huifu's Strength & Reliability

Robust anti-money laundering and anti-fraud risk control system

Secure, efficient, and local digital payment solutions for local merchants

Committed to providing an exceptional service experience for merchants

No matter where you are or what problem you encounter, you can get timely answers and assistance with just a phone call or online inquiry

Fast activation for new merchants with complete application materials

To ensure fund security and transaction stability, we implement strict fund segregation, efficient settlement, data backup, and anomaly recovery

Strict fund segregation (client vs. company), held in separate accounts, ensuring client funds are protected from company operational risks

Efficient settlement systems and processes, reducing funds in transit and effectively lowering financial risk

Technical data backup and recovery readiness, ensuring transaction system stability

Established comprehensive anomaly handling and recovery mechanisms for rapid processing and recovery in case of abnormalities

Licenced with AFSL, completed AUSTRAC registration, operating legally and compliantly

AFSL licence number 537019

Strictly adheres to Australian and international laws and regulations, including anti-money laundering and counter-terrorism financing

Complies with local customer data and privacy protection policies, employing advanced technology and management measures to ensure customer privacy and security

Strictly complies with PCI certification standards, building a secure payment environment and safeguarding payment card information

Advanced tech for real-time risk transaction monitoring and interception, effectively protecting funds

AI and machine learning to control transaction risks, maximizing security and improving risk identification and interception accuracy

Shared risk control models with partners and third parties to jointly improve risk prevention capabilities.

All-round risk interception (pre, during, post), risk disposal planning, and timely, effective responses to maximize protection of your rights